KIGALI, RWANDA, 24 January, 2011 – Political risk insurance and trade credit insurance will play a major role in Rwanda’s strategy to become a middle income country by 2020. Coupled with country’s aggressive business reforms, this specialty insurance is expected to increase Rwanda’s already impressive Foreign Direct Investments and Export volumes. Stewart Kinloch, Chief Underwriting Officer of the African Trade Insurance Agency (ATI), delivered this message to the business community in Kigali during a workshop series held at the Hôtel des Mille Collines.

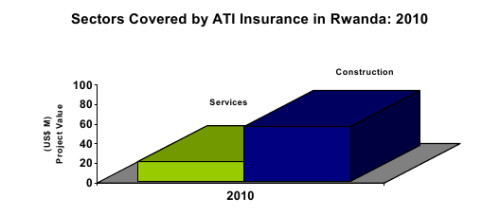

“In under a decade Rwanda has evolved into a mecca for business. This phenomena is reflected in the number of enquiries ATI receives from investors interested in Rwanda and from Rwandan businesses seeking insurance to help them expand safely into the EAC market. In 2010 ATI closed its first deals in Rwanda where we provided insurance cover on two projects – a cement factory expansion and a services industry project – valued at $76 million,” noted Kinloch.

The insurance workshops, designed to increase knowledge and awareness about investment & trade credit insurance, target bankers, insurance brokers and the media. This initiative is supported by the Rwandan government, which is a founding member of ATI. In addition to marketing initiatives, ATI may also open a local office in Kigali enabling it to work more closely with the business community and to develop a project pipeline of over $400 million.

ATI offers two unique insurance products – political risk insurance also known as investment insurance that protects investors and lenders from any government actions or politically motivated violence that could negatively impact their business interests. The other major insurance that ATI offers is trade credit insurance, which covers commercial non-payment and payment default risks of clients who include exporters, importers, manufacturers and banks.

Trade credit insurance is particularly important to companies, who in the current economic environment may find it difficult to access credit or to compete with foreign counterparts. This is an insurance product that exporters in Europe and North America have been using to great benefit for decades. Exporters from these markets are insured by their national export credit agencies against risks such as non-payment enabling them to do business anywhere in the world while also increasing their credit worthiness. Alternatively, African exporters who often trade on cash against documents or Letters of Credit terms of payment are often disadvantaged. With ATI offering many of the same services, African exporters will be able to compete with their foreign counterparts.

Rwanda’s growth trajectory is expected to continue with a GDP growth forecast of 6.2% and ATI stands ready to support investors interested in Rwanda. In 2010, ATI logged interest from investors in Belgium, Burundi, France, Israel, the UK and USA. Here is the complete list of enquiries logged by ATI in 2010.

2010 Business Enquiries

| Country Investor

|

Project | Sector |

Project Value

(US$ M) |

| Belgium | Insurance to rehabilitate a radio and TV building | Telecommunications |

17.6

|

| Burundi | Terrorism & Sabotage insurance | Services |

25.2

|

| Burundi | Terrorism & Sabotage insurance | Services |

9.9

|

| France | Insurance on a road maintenance contract | Infrastructure |

18.2

|

| Israel | Insurance on an equity investment & commercial loan | Energy |

70.0

|

| Multilateral | Insurance on a credit facility to purchase Boeing airplanes | Transport |

60.0

|

| Multilateral | Insurance to develop housing units | Construction |

3.5

|

| Rwanda | Credit guarantee on a loan to construct a hotel | Construction |

2.6

|

| Rwanda | Insurance to develop a 5-star | Infrastructure |

52.0

|

| Rwanda | Insurance on a power generation project | Energy |

44.5

|

| United Arab Emirates, Dubai & Hong Kong | Insurance on the supply of GSM handsets | Telecommunications |

0.5

|

| United Kingdom | Insurance on the purchase of airplanes | Services |

14.0

|

| United Kingdom | Insurance on property and land development | Agribusiness |

40.0

|

| United Kingdom | Insurance to develop real estate | Construction |

50.0

|

| USA | Trade credit risk insurance on a agribusiness project |

Agribusiness |

0.5

|

|

Total:

|

408.0 |