NAIROBI, 5 June 2015 – The African Trade Insurance Agency (ATI) held its 15th Annual General Meeting of shareholders today. During the opening ceremony, the Chief Guest, Hon. William Ruto, EGH, the Deputy President of the Republic of Kenya, commented that ATI is helping to rewrite the African narrative to one that reflects the continent’s positive transformation. In his statement, he referred to ATI’s impressive results in sectors that are vital to Africa’s growth.

ATI is a unique institution. The company provides political/investment and credit risk insurance to investors and companies doing business in Africa. Since inception, ATI has covered over $17 billion worth of trade and investments in its member countries. In 2014, they posted impressive results in the following key sectors:

Energy

• ATI covered transactions valued at over $1 billion in its member countries; and

• ATI supported Africa’s largest wind farm, the Lake Turkana Wind Power Project, which brought in $800 million worth of investments and is expected to add 300 MW to Kenya’s power supply and to save the government $150 million annually in foreign currency and fuel adjust costs.

Financial Services

• Nearly 80% of ATI’s current business involves banks, covering direct loans or a bank’s entire portfolio of clients in the SME sector, issuing counter guarantees on bonds and insuring banks’ trade finance products.

Infrastructure

• ATI supports infrastructure development by covering sovereign risks associated with these projects. This adds extra security to government-backed projects and makes them more bankable and appealing to investors.

Insurance

• ATI has provided additional capacity of $750 million to the market enabling insurers to supply to its customers new products such as Political Violence, Terrorism & Sabotage insurance. ATI’s participation helps local insurers offer greater protection to companies and investors.

Manufacturing

• ATI facilitated trade and investments in the sector valued at over $190 million

• ATI has helped attract international financial institutions to the sector helping companies to import needed supplies, expand safely into new markets and to scale up their output with imports of high-end manufacturing equipment.

Though ATI is currently restricted to covering political and investment risk transactions in its existing 10 member countries, an initiative is underway that is expected to significantly increase ATI’s market share. Through a partnership with the ECOWAS bloc of countries, ATI plans to expand into West Africa and to establish a regional hub within the next few years.

ATI’s Board of Directors also provided the company with another window for expansion with the decision, taken in 2014, to enable ATI to conduct its commercial (credit) risk business in non-member countries.

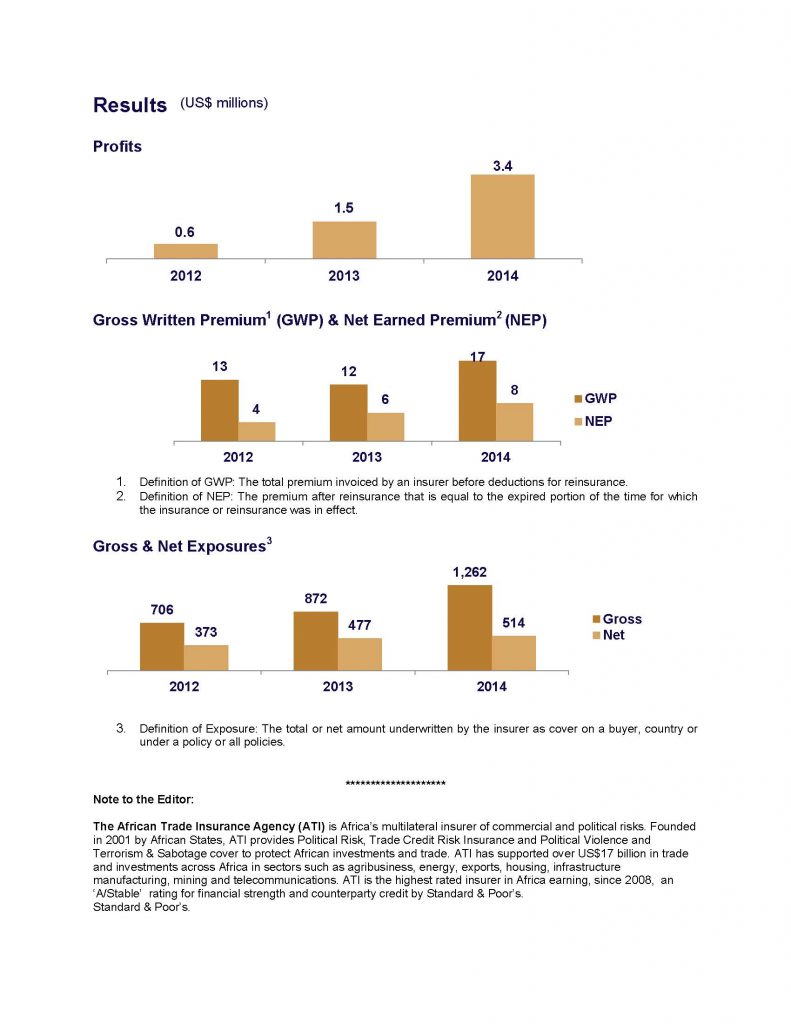

The company’s strong balance sheet combined with its notable impact within key sectors is proving to be a winning proposition for prospective member countries and other shareholders. At a recent event, ATI’s top executives – George Otieno, Chief Executive Officer; Jef Vincent, Chief Underwriting Officer; and Toavina Ramamonjiarisoa, Chief Financial Officer – unveiled ATI’s record-breaking results, which included a third consecutive year of profitability.

During the press event ATI’s CFO noted that “our extremely strong capital adequacy and liquidity are part of the key ingredients supporting our A/Stable rating and making us an attractive company for prospective shareholders like ECOWAS.”