WASHINGTON, DC, 8 October 2010 – ‘Securing prosperity for all’ is the theme of the seminars being held during the World Bank and IMF Annual Meetings. Specifically the discussions will focus on how to create jobs and rebuild fragile states and economies in support of the millennium development goals. Lack of progress on international trade reforms tops the list of obstacles seen to be preventing the continent from moving toward sustainability.

Speaking on the sidelines of the meetings, ATI’s newly appointed CEO commented on the need for Africa to set the agenda “We cannot wait for the international community to dismantle trade barriers. African exporters must become more competitive and African investors must put more of their money back into Africa. This is how we will begin to grow our economies, from the inside.”

If more African exporters increased their uptake of trade insurance products, they would be better equipped to venture into new and more profitable markets, the CEO added. Markets such as China which has increased its trade with Africa by 92% in the last decade are potentially ‘the new wave’ of export destinations for African goods. To benefit from these opportunities exporters must take advantage of insurance products. Studies have shown that exporters with trade insurance obtain upwards of 50% or more for their goods in contrast to uninsured traders.

Similarly, African investors, who may be risk averse to investing in their own continent, can do so safely with insurance products backing their investments thus boosting much needed levels of intra-regional foreign direct investments (FDI). Intra-African investments currently account for 13% 1of all FDI flows into Africa, amongst the lowest in the world. In contrast, intra-regional trade in the Association of Southeast Asian Nations (ASEAN) region accounts for 30% of all FDI flows.

The African Trade Insurance Agency (ATI) was created by African governments as a means to find an African solution to attracting FDI by providing trade and investment insurance products. The Agency recently released its first half results and as it approaches its 10th anniversary in 2011, a notable growth trend underscores ATI’s relevance to bridging Africa’s development gap.

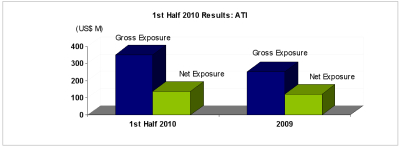

In the first half of 2010, ATI recorded substantial increases in its main business lines. (increases are compared to results for the full year, 2009):

The Agency also posted $2.5 million worth of Gross Written Premium in the first half, representing 69% of the earned Gross Written Premium for all of 2009. And on the demand side, ATI continues to see a vibrant project pipeline valued at nearly $ 6.2 billion for the first three quarters of 2010.

“The biggest challenge we face, notes Mr. Otieno, is education and misinformation about the benefits and purpose of trade and investment insurance. If the rest of the world has been using these insurance products to their advantage for decades, then Africa also needs to jump in the game.”

As part of its 10th Anniversary initiatives, ATI plans to release a series of reports in 2011 that examine the level and depth of African trade flows and the impact over the past decade of ATI’s insurance products in attracting FDI and supporting trade on the continent.