NAIROBI, 5 March 2014 –What happens when you merge a career banker and a serial tech entrepreneur? The result: Umati Capital, a new venture which changes the way in which businesses interact with technology to access faster and cheaper capital. ATI chose to cover the transaction based on Umati’s ability to effectively address the core challenges faced by SMEs – which is at the heart of the Pan African insurer’s growth strategy.

The two co-founders of Umati Capital – Munyutu Waigi, the co-founder of Rupu, a popular online shopping platform and Ivan Mbowa, who was a senior manager at Citigroup – are young and talented. Having already experienced success in their own right, their latest venture is stirring the capital markets.

What is the problem addressed by Umati Capital? While it may appear that SMEs have numerous financing options offered by banks, they will often find themselves stuck between high double digit interest rates and heavy collateral requirements.

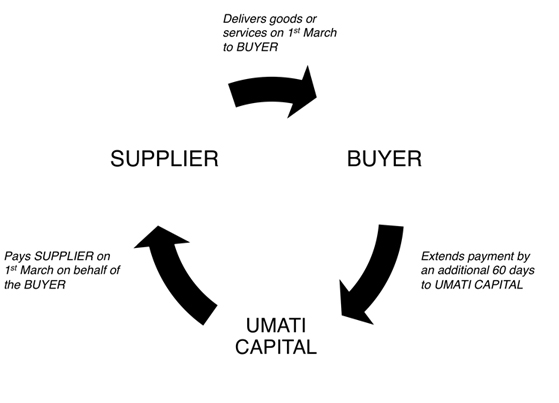

The solution: Without requiring collateral, Umati Capital offers a tailored financing solution to businesses helping them manage their supply chain and ease pressure on their cash flow.

Umati Capital fills a unique space in the market. The company leverages technology to provide innovative supply chain financing to SMEs who supply to larger entities.

Case study: The dairy industry has proven to be the first successful test for Umati Capital. Emerging milk processors face the challenge of addressing rising consumer demand and tighter cash flow positions. In order for their milk suppliers to capitalise on this demand, they had to forego payment for up to one-and-a half months. This arrangement left milk suppliers exposed on a monthly basis to mounting expenses.

In response to this challenge, Umati Capital introduced innovative technology to help streamline production processes from milk collection to supplier payments. As a result, milk suppliers can now access payment within 48 hours of milk delivery and milk processors can repay Umati Capital within 60 days instead of the usual 30-45 days. In the coming months, Umati Capital plans to roll out their unique blend of technology and financing to tackle other challenges facing SMEs in other sectors.

At a press conference today in Nairobi with Rennie Kariuki, ATI’s Underwriter responsible for Kenya explained ATI’s interest in the initiative while the Umati Capital co-founders Munyutu Waigi and Ivan Mbowa explained how they joined forces to form a unique company created to fill a market gap.

“We believe that access to capital should be guided by transparent access to information through the use of technology,” notes Munyutu Waigi, co-founder of Umati Capital. Ivan Mbowa adds “we are eager to partner with businesses across agriculture, the hotel industry & local manufacturing to find innovative ways of structuring financing solutions which work for them and their suppliers.”

ATI’s Rennie Kariuki commented that “Umati Capital’s model was a viable way for ATI to support two important sectors of the economy simultaneously – agriculture and SMEs. We were able to cover Umati against payment default risks primarily because of the co-founders’ solid track records and their business model. Typically most start-ups would have to source this type of insurance cover on the international markets, which probably would have declined the transaction. This is the unique space that ATI is trying to fill in Africa with commercial risk insurance.”

In February 2014, ATI launched a unique product that will enable them to provide greater support to the SME sector through banks. The product is able to cover a bank’s their entire lending portfolio to SMEs, which allows them to increase their lending volumes while containing their default levels. NIC Bank was the first bank to sign onto the cover. The product is expected to be picked up by most of the tier-one lenders in Kenya and in the East African region this year as banks continue to encounter rising default rates on their loan books.