KINSHASA, DR CONGO, 21 February, 2011 – DR Congo is entering a period of uncertainty as investors anxiously await the outcome of a presidential election and the resolution of cases bought by two mining companies to the International Court of Arbitration in Paris over illegal license transfers. According to the African-based insurer, the African Trade Insurance Agency (ATI), DR Congo is a risky place to do business but no more risky than Egypt and Tunisia are today or Kenya was in 2008. “We operate in a dynamic region where a country’s stability may not be guaranteed,” noted Stewart Kinloch, Chief Underwriting Officer during workshops on political risk and export credit insurance aimed at the banking and insurance sectors and the media.

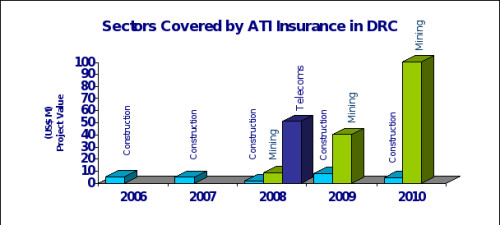

“In 2010 ATI estimated that DR Congo’s risk premiums had increased by 40% over 2009. Despite this cost, we’ve seen our business in DR Congo triple in 2010. From our experience, investors who are covered by insurance are not easily dissuaded because the potential reward far outweighs the risks of doing business here,” noted Mr. Kinloch.

Investors receive greater protection with ATI’s political risk insurance products. As a shareholder and member of ATI, DR Congo’s investment goes hand-in-hand with a pledge to prevent claims caused by government actions on ATI projects. In 2010, ATI provided political risk insurance on projects to construct housing and the mining industry in DR Congo valued at $172 million. Through these deals, ATI was able to facilitate investments into DR Congo from other African countries, Europe and North America. “One of ATI’s strengths is this unique partnership we have with our African member countries. Investors take extra comfort in this value-added dimension to our insurance,” explained ATI’s Chief Underwriting executive.

ATI offers two primary insurance products – political risk insurance also known as investment insurance that protects investors and lenders from any government actions or politically motivated violence that could negatively impact their business interests. The other major insurance that ATI offers is export credit insurance, which covers commercial non-payment and payment default risks against contracts with private companies, the government or government agencies. While demand for political risk insurance in DR Congo generally outstrips demand for export credit insurance, ATI has noted a significant increase in their business pipeline for export credit insurance. Typically these enquiries are from lenders, suppliers and manufacturers seeking to ship goods to DR Congo or from contractors entering into a contract with a government agency.

In 2010, ATI built a business pipeline in DR Congo valued at $770 million. With growth projections estimated at 6.8%, a reduction on its international debt load, drastically reduced inflation rates and strong global commodity prices, ATI predicts that despite the current challenges, investors will continue to search for opportunities in the country. In order to capitalize on this increasing demand, ATI plans to open a local office in Kinshasa by year end.

The ATI workshops are part of a marketing effort to raise local awareness of these insurance products in African markets where ATI conducts business. The Kinshasa workshops, conducted by Mr. Kinloch and ATI Underwriter will continue to 22 February at the Faden House Hotel.

ATI’s Business Pipeline of Projects in DR Congo

| Country Investor

|

Project | Sector |

Project Value

(US$ M) |

| Belgium | Insure the delivery of construction equipment | Infrastructure |

50.0

|

| Botswana | Insure the financing of a mine | Mining |

20.0

|

| DR Congo | Insure the supply of fertiliser | Agribusiness |

0.5

|

| European Union | Insure metal exports | Telecommunications |

7.0

|

| France | Insure the construction of power lines | Energy |

7.6

|

| France | Insure the rehabilitation of power lines | Energy |

98.3

|

| France | Insure the supply and installation of equipment to rehabilitate control towers | Infrastructure |

14.1

|

| France & Norway | Insure the supply of navigation equipment for the airport | Transport |

6.3

|

| Germany | Insure a contract to rehabilitate the airport | Infrastructure |

56.3

|

| Germany | Insure the construction of a social housing project | Infrastructure |

82.0

|

| Germany | Insure copper trading deals | Mining |

70.0

|

| Israel | Insure bank financing on the sale and lease of equipment | Telecommunications |

60.0

|

| Italy | Insure a contract to purchase vehicles | Services |

1.1

|

| Kenya | Insure a contract to supply vehicles for a government ministry | Transport |

37.2

|

| Nigeria | Insure a housing project | Construction |

20.0

|

| South Africa | Insure a project loan | Manufacturing |

20.3

|

| South Africa | Insure a lending facility | Mining |

52.0

|

| South Africa | Insure a commercial loan | Agribusiness |

3.7

|

| South Korea | Insure a commercial loan | Services |

140.0

|

| Spain | Insure a loan guarantee | Construction |

4.5

|

| United Kingdom | Insure the sale of port equipment to the government | Transport |

11.0

|

| USA | Insure the delivery of refined petroleum products | Energy |

2.0

|

| USA | Insure a contract to deliver frozen poultry | Services |

0.1

|

| USA | Insure a contract to supply chemicals and equipment | Infrastructure |

3.0

|

| Zimbabwe | Insure equity financing for a copper smelting project | Mining |

2.0

|

| Zimbabwe | Insure pre-export financing to purchase copper ore | Mining |

1.5

|

| Total |

$770.5

|