DAR ES SALAAM, TANZANIA, 1 December 2010 – In a bid to increase awareness and reach out to existing customers, the African Trade Insurance Agency (ATI) is conducting a two-day series of seminars targeting insurance brokers, bankers and the media.

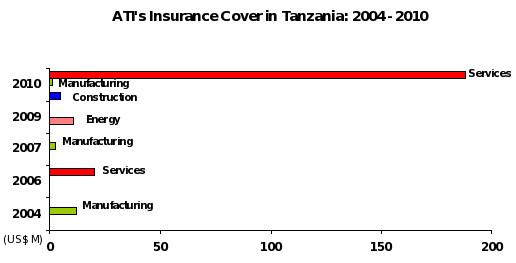

Since the launch of its local office in April this year, ATI has increased its business in Tanzania from a transaction value of $11 million in 2009 to over $195 million in 2010 – representing an increase of over 1000% benefiting the energy, manufacturing and services sectors. The multilateral insurer also supported investments into Tanzania from Canada, Italy and Mauritius in support of transactions valued at over $24 million.

“The purpose of these seminars is to educate the local market about our unique investment and trade credit insurance products. These instruments can protect exporters branching out into news markets, banks against loan defaults and investors interested in riskier markets,” explained Stewart Kinloch, ATI’s Chief Underwriting Officer.

In Tanzania, the benefits, particularly during the current economic climate, can be enormous. Some of the common business issues that this insurance can help alleviate include:

Local exporters suffering from non-payment and other risks as their clients in Europe and elsewhere default on payments.

ATI offers two unique insurance products – political risk insurance also known as investment insurance, and trade credit insurance. Together these products have helped increase the competitiveness of African exporters as well as attracting foreign direct investments over the last decade. Trade credit insurance is a product that exporters in Europe and North America have been using to great benefit for decades. Exporters from these markets are insured by their national export credit agencies against risks such as non-payment, enabling them to do business anywhere in the world. This makes them more competitive than African exporters, who often trade on cash against documents or Letters of Credit terms of payment. ATI is Africa’s export credit agency, offering many of the same services that could help increase Africa’s competitiveness.

In this chart, the services category includes increasing capacity to the local insurance market with reinsurance products and supply of equipment to the transportation industry.

Specifically, political risk insurance, is insurance that investors, whether they be African or foreign investors, can obtain to protect their business interests against government actions or politically-motivated violence that may impact negatively on their business. This provides protection for investors and lenders interested in bringing their money to Tanzania. ATI’s unique advantage is that African countries such as Tanzania have invested their money to become members of the Agency, therefore governments have no reason to cause any claims. Investors are reassured by this relationship and have chosen ATI’s political risk insurance over foreign-based companies, precisely because ATI is an African institution with a clear understanding of the challenges and opportunities inherent in the business environment here.

To increase awareness in the Tanzanian market, ATI’s Country Representative, Mr. Albert Rweyemamu and Mr. Stewart Kinloch will host a series of workshops from 6th to 7th December at the Mövenpick hotel.