NAIROBI, KENYA, 2 December 2010 – Next year marks the pivotal 10th anniversary of the African Trade Insurance Agency (ATI). With an average business growth trend of 80% in the last two years, expansion into West Africa and increased demand for its insurance products, ATI’s Board of Directors approved enhanced risk limits to accommodate this growth. This increase allows ATI to retain more risk on its books and to pursue larger projects at gross exposure levels of $100 million for political risk insurance and $50 million for commercial risk insurance products – a 33% increase over the previous risk limits. For larger projects, ATI will obtain reinsurance from partners such as the Lloyd’s of London insurance market, the corporate insurance market and other international, multilateral and export credit agencies.

“We believe this increase in our risk limits will help African countries attract much needed financing for infrastructure projects. In cases where governments are unable to offer guarantees to investors ATI can step in to provide a viable alternative. In Kenya, for example, independent power providers in the energy sector would benefit as would the government’s long-term infrastructure plans”, noted George Otieno, ATI’s recently appointed CEO.

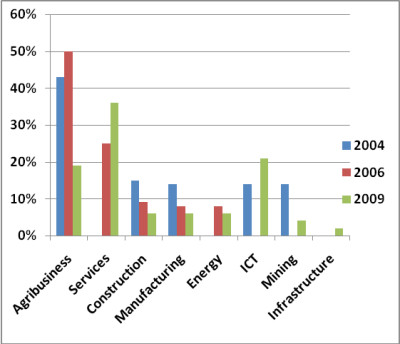

Since writing its first policy, ATI has supported over $2 billion worth of African investments and exports. Specifically, a majority of ATI’s support has gone to the agriculture and services sector and in recent years, the Information and Communication Technology sector has seen a surge.

In preparation for its 10th anniversary in 2011, ATI commissioned an independent survey of its impact over the last decade in Africa. The report, produced by International Financial Consulting of Canada, praised ATI for its Impact on Regional Trade and Risk Mitigation in Africa and awarded it a score of “Excellent” for its Relevance to African countries.

The Impact Assessment Report, which will be released next year, also revealed that because of its insurance products, ATI’s clients were on average able to improve their business position:

“The report shows that ATI is making a difference to African companies and to our member countries which are able to attract more foreign investments with ATI’s backing. As Africa’s strongest trading partners in the Euro zone continue to experience financial instability, the continent will need to remove all possible ‘risk’ obstacles to other investors bringing their money here,” observed Mr. Otieno.

Armed with positive Impact results, an increased risk limit, and a reaffirmed investor grade ‘A’ rating from Standard & Poor’s – which ranks ATI as the second highest rated institution in Africa – ATI is confident of another decade of similar, if not better, growth.