NAIROBI, 29 April 2013 – India-Africa trade received a boost with the signing of a Memorandum of Understanding (MOU) between the Export Credit Guarantee Corporation of India Ltd (ECGC), a government owned institution with a mandate to help Indian firms expand into new markets and the African Trade Insurance Agency (ATI), Africa’s Export Credit Agency. Signed on the side lines of the Berne Union’s Annual Spring Meetings in New York, the MOU comes at a time when India-Africa business ties are at an all-time high as India focuses on increasing its presence in Africa through trade, foreign direct investments and skills transfer initiatives.

During the signing, ATI’s Chief Underwriting Officer, Jef Vincent, noted “We have seen a steady flow of interest coming from India in recent months. This agreement signals to companies in both India and Africa that we are ready to cover your transactions – whether it’s a pharmaceuticals exporter from Maharashtra, India or an importer of medical supplies from East Africa, ECGC and ATI are in a position to cover both sides of the deal.”

In a show of just how important Africa is to India the country’s trade target with Africa was revised upwards from $70 billion in 2012 to $90 billion by 2015. This is an increase of $20 billion from the original target. India is expected to enhance economic and commercial relations specifically in the areas of agriculture, agro-processing, manufacturing, pharmaceuticals, railways, energy and petroleum and natural gas.

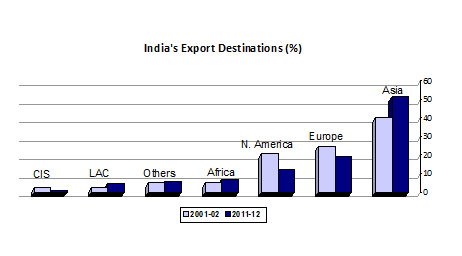

According to the Export-Import Bank of India (Exim bank), mandated to finance and facilitate exports from India, the trend in the country’s export patterns indicate a move towards increased South-South trade, particularly in Asia and Africa. This is in sharp contrast to trade with Europe and North America, which has seen a decline from 2002 to 2012.

(LAC stands for Latin America & the Caribbean & CIS for the Commonwealth of Independent States) Source: Exim Bank of India

In the vital area of investments, India is also making inroads into Africa. According to the Federation of Indian Chambers of Commerce and Industry, India is now the 9th largest source of FDI with two sectors absorbing the bulk of FDI – the natural gas sector attracts 43% of the total FDI and manufacturing 29%.

To deepen its roots and to further increase its reach into Africa, India has also established a number of pan-African institutions aimed at increasing capacity and human resource development. These institutions include the India-Africa Business Council, which will lead the country’s commercial and economic interests in Africa, the India-Africa Institute of Foreign Trade, the India-Africa Diamond Institute, the India-Africa Institute of Educational Planning and Administration and the India-Africa Civil Aviation Academy.

The agreement with ATI is expected to help further advance India’s objectives in Africa. As a trusted financial institution with an established footprint, ATI will be able to cover the political and commercial risks of Indian exporters while also protecting African exports to India.

This agreement adds to a growing list of partnerships that ATI has actively sought in order to expand its reach including with the Export Credit Insurance Corporation of South Africa (ECIC), the Export Credit Guarantee Company of Egypt (ECGE), Germany’s Euler Hermes Kreditversicherungs-AG, the Jeddah-based Islamic Cooperation for the Insurance of Investment and Export Credit (ICIEC), Belgium’s ONDD, the United States’ Overseas Private Investment Corporation (OPIC) and China’s Sinosure.