LUSAKA, ZAMBIA, 13 October, 2010 – The Zambian private sector community is set to benefit from insurance that will help to reduce risks currently born by the country’s exporters, suppliers, lenders and investors. At a meeting hosted by the Zambia Association of Chambers of Commerce & Industry (ZACCI), the Chief Underwriting Officer of the African Trade Insurance Agency (ATI), Stewart Kinloch noted that Zambia could attract more investments and its exporters could be more competitive in foreign markets if only more people understood the benefits of trade credit and investment insurance products.

“Insurance can provide a simple solution to some of the common problems faced by Zambian companies. For example, Zambian investors and businesses seeking financing for their projects are unable to negotiate favourable terms with their local or foreign banks as a result of credit risks. Zambian importers are told to pay up front because they are unable to negotiate credit terms with their foreign suppliers as a result of default risks. And Zambian exporters are suffering from non-payment and other risks as their clients in Europe and elsewhere default on payments. This doesn’t have to be the case,” noted Mr. Kinloch.

Trade credit insurance is a product that exporters in Europe and North America have been using to great benefit for decades. Exporters from these markets are insured by their national export credit agencies against risks such as non-payment, enabling them to do business anywhere in the world. This makes them more competitive than African exporters, who often trade on cash against documents or Letters of Credit terms of payment. ATI is Africa’s export credit agency, offering many of the same services that could help increase Africa’s competitiveness.

To help boost Zambia’s export potential, ATI began underwriting trade credit insurance policies in the Zambian market last year. Though the product can increase the price that exporters receive for their goods by as much as 50% while also reducing their bank financing costs, the challenge ATI faces is lack of awareness of the product in the Zambian marketplace.

As the voice of the private sector in Zambia since 1933, ZACCI provides an ideal platform to speak to this community. “We continue to be focused on raising awareness about opportunities, such as the ones that ATI is bringing to the market, that can help to improve Zambia’s competitiveness,” noted ZACCI President, Mr. Hanson Sindowe.

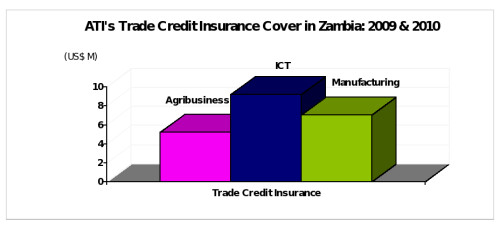

ATI has covered transactions worth $21.5 million under the trade credit insurance program in the sectors of agribusiness, Information & Communication Technology (ICT) and manufacturing.

The breakfast meeting also featured a keynote address by the Honourable Situmbeko Musokotwane, Minister of Finance and National Planning, who led a discussion with Zambia’s private sector on the recently released national budget. A key focus of the budget dealt with the government’s quest to attract more investments to build much needed infrastructure. Here too ATI offers a solution in the form of both trade credit and political risk insurance.

Specifically, political risk insurance, is insurance that investors, whether they be African or foreign investors, can obtain to protect their business interests against government actions or politically-motivated violence that may impact negatively on their business. This provides protection for investors and bankers interested in bringing their money to Zambia. This insurance program supplements the provisions of the ZDA Act in offering comfort to foreign investors.

ATI’s unique advantage is that African countries such as Zambia have invested their money to become members of the Agency, therefore governments have no reason to cause any claims. Investors are reassured by this relationship and have chosen ATI’s political risk insurance over foreign-based companies, precisely because ATI, is an African institution with a clear understanding of the challenges and opportunities inherent in the business environment here.

Since writing its first Political Risk Insurance policy in Zambia, ATI has covered transactions valued at $195.7 million in the sectors of construction, energy, ICT, manufacturing and mining.

The Zambian market continues to show strong demand for ATI’s products reflected in a robust project pipeline. Already in 2010, up to the third quarter, ATI has responded to enquiries valued at $77.8 million for both trade credit and political risk insurance products.

To increase awareness in the Zambian market, ATI’s Zambia Country Representative, Mr. Pizzaro Lukhanda and Mr. Stewart Kinloch will host a series of meetings with the media, bankers and insurance brokers on the 13th and 14th October in Lusaka.

*********************

The Zambia Association of Chambers of Commerce & Industry (ZACCI) Established in 1933, ZACCI is the National Chamber of Commerce and Industry representing District Chambers, affiliate business membership organizations, companies, including some public sector agencies that are supporting the growth of the private sector. ZACCI is the voice of the private sector that strives to create a conducive business environment for economic growth in Zambia.

For more information, www.zambiachambers.org.